1. Development of the photovoltaic industry in the world and key countries/regions

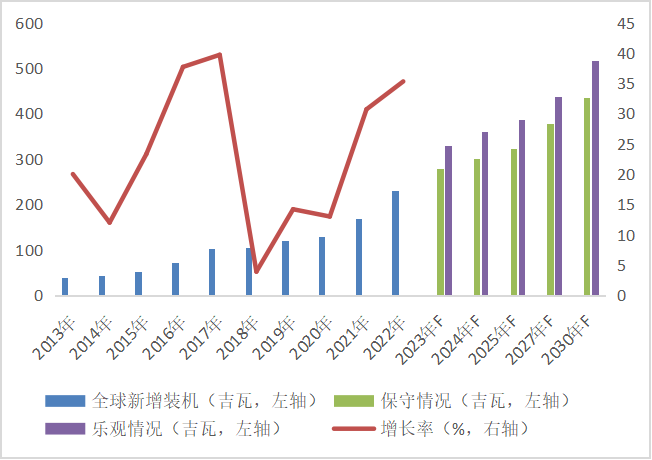

From the manufacturing end of the photovoltaic industry chain, the production scale of the manufacturing end of the global photovoltaic industry chain continued to expand throughout the year of 2022, driven by the demand of the application market. According to the latest data released by the China Photovoltaic Industry Association in February 2023, the global newly installed photovoltaic capacity is expected to be 230 gigawatts in 2022, with a year-on-year growth of 35.3%, which will further expand the production capacity of the manufacturing end of the photovoltaic industry chain. In the whole year of 2022, China produced 806,000 tons of PV polysilicon, up 59% year on year. According to the industry’s calculation of the conversion ratio between polysilicon and modules, the component output of available PV polysilicon in China in 2022 is about 332.5 gigawatts, an increase of 82.9% compared with 2021.

Figure 1 Global installed PV capacity, 2013-2030

In terms of production layout, the Chinese mainland is still a place of production capacity, accounting for 98% of the world’s total silicon wafer production capacity, over 85% of battery wafer production capacity, and about 77% of component production capacity. In recent years, the global industrial focus has further shifted to the Chinese mainland. In 2022, the output of silicon wafers, battery wafers and components in the Chinese mainland accounted for more than 80% of the world’s total output, showing a momentum of rapid growth.

In terms of countries/regions of focus:

Europe: According to data released by the European Photovoltaic Association, 41.4 gigawatts of new photovoltaic installations will be installed in the 27 European Union countries in 2022, an increase of nearly 50% over the same period last year, with an optimistic forecast of nearly 120 gigawatts of new photovoltaic installations in 2026. Germany topped the list with 7.9 gigawatts of new installations in 2022. Next came Spain, with 7.5 gigawatts of new capacity. Germany is expected to add more than 10 gigawatts in 2023 and a cumulative 62.6 gigawatts in 2023-2026. Spain is expected to add 51.2GW of new installations between 2023 and 2026, bringing cumulative installations to 77.7GW from 26.4GW in 2022. In December 2022, the German parliament approved a new package of tax breaks for rooftop PV, including VAT exemption for PV systems under 30 kW. The newly amended German Renewable Energy Act (EEG) stipulates that from 2023, all photovoltaic components, including modules and inverters, will be allowed to be replaced in an existing photovoltaic power station in Germany without the need for a lengthy approval process as long as no additional land is added. It is expected that the total installed photovoltaic capacity in Germany will double after the implementation of the new policy.

Figure 2 Installed photovoltaic capacity in some European countries in 2021-2022

Brazil: According to Fitch, citing statistics from Brazil’s Ministry of Mines and Energy, Brazil’s total installed PV capacity reached 22 gigawatts in 2022, with 9.0 gigawatts of new capacity added, representing a 73.3% year-on-year increase. Brazil will start charging grid royalties for small distributed projects in 2023 as a result of the Distributed Generation Act introduced in January 2022. As distributed projects in Brazil account for over 65% of total installations, this act has significantly impacted the market and created a rush to install, making Brazil one of the hottest markets for PV installations in 2022.

India: In 2022, India installed 13.96 gigawatts of solar PV systems, an increase of nearly 40% over the previous year, according to research data from Indian PV consultancy JMK. This includes utility-scale PV of 11.3 GW, up about 47% year on year, and some rooftop distributed PV and off-grid/distributed capacity.

Japan: Installed PV capacity in Japan reached 77.6 gigawatts in 2022, up 4.4% from the previous year, with 3.1 gigawatts of new PV capacity installed, according to Fitch and EIA. In January 2023, the Tokyo Metropolitan Assembly voted to pass the revised ordinance on “requiring the installation of solar panels in new residential buildings in Tokyo from April 2025”, which obliges owners of large residential buildings and one-family residential buildings of less than 2,000 square meters to install solar panels on their roofs. In addition, the Ministry of Economy, Trade and Industry (METI) will implement a policy from 2024 to purchase the electricity generated by companies through rooftop PV at a premium, with a fixed price purchase system (FIT). The purchase price is expected to be 20 to 30 percent higher than the price of surface PV.

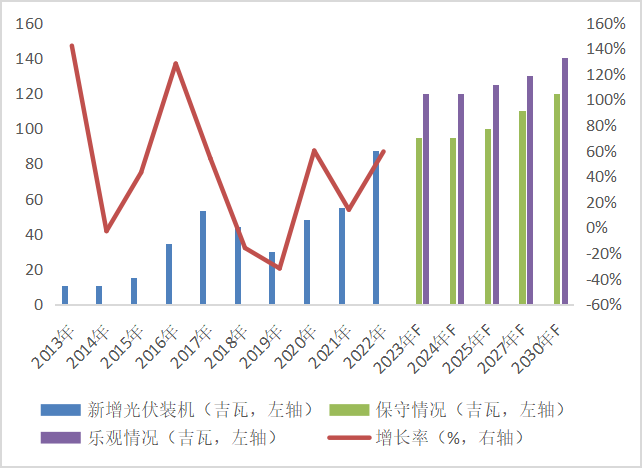

China: According to the National Energy Administration, in 2022, China’s newly installed PV capacity was 87.41 gigawatts, up 59.3% year on year and 45 percentage points higher. Distributed PV has become an important growth point of PV capacity. The China Photovoltaic Industry Association expects 95-120 gigawatts of new PV capacity to be installed in 2023 and 100-125 gigawatts in 2025. It is expected that in 2023, the cumulative installed photovoltaic power will surpass hydropower for the first time and become the largest non-fossil energy power source. According to incomplete statistics of photovoltaic industry association, a total of 18 photovoltaic related policies were issued in January 2023. Among them, there are 3 national policies and 15 local policies. The policy includes promoting the advancement and industrial application of smart photovoltaic technology, encouraging and supporting the direct participation of industrial and commercial users of 10 kV and above in the electricity market; We will guide the balanced development of solar photovoltaic, energy storage technologies and products to avoid overcapacity and vicious competition.

Figure 3 China’s newly added photovoltaic installations from 2013 to 2030

Us: The US PV market is one of the few markets in decline, with new solar capacity in the US estimated to be 23% lower in 2022 than in 2021 as trade restrictions with China discourage imports of key low-cost components and materials used in PV equipment.

For the enterprises in the photovoltaic industry chain, under the background of the high increase of downstream installed demand, the leading manufacturers show a more stable performance growth. 2022 is a big year for the “crossover” photovoltaic of major listed companies. Judging from the performance disclosed so far, most of the “crossover light chasers” have not yet realized the profits of the photovoltaic business. The leading photovoltaic enterprises have scale advantages and first-mover advantages, and constantly expand production capacity, which makes the pressure of photovoltaic enterprises and second – and third-line manufacturers to enter the market greater. The large scale and low cost of integration may make the profits of some links more concentrated, and the trend of constant strength of the strong is becoming more obvious. The reshuffle trend of small manufacturers may gradually emerge.

2. Export trade of photovoltaic industry chain products

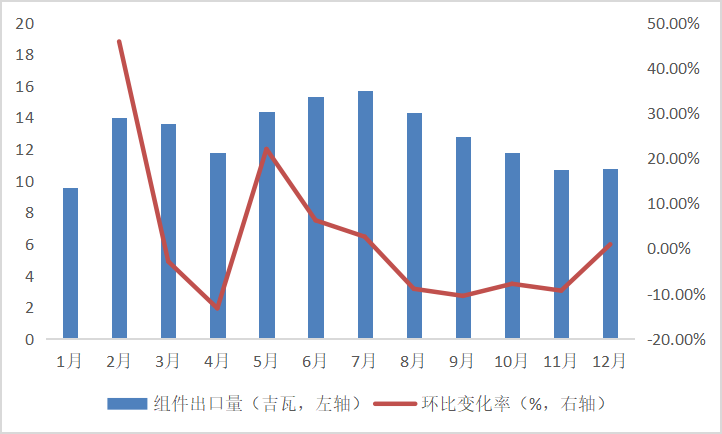

China: China’s PV module exports rose slightly in December 2022, bucking the trend of decline since the July export peak. In 2022, the export volume of PV modules reached 154.8 gigawatts, an increase of 74% compared with 2021. Exports amounted to $42.375 billion, up 65.45 percent year on year. The export peak was from May to July in the middle of the year. Then, due to the large amount of imports in the first half of the year, the overseas market slowed down the pulling power of goods. The export volume of components declined continuously until November and stopped falling and rising in December.

Figure 4 China’s PV module exports from January to December 2022

Europe: In 2022, European countries imported 86.6 gigawatts of PV modules from China, accounting for 56% of China’s annual PV module exports, and a significant increase of 112% compared to 40.9 gigawatts in 2021, making it the fastest growing and largest regional market for Chinese module exports in 2022. In 2022, due to the impact of the conflict between Russia and Ukraine, the price of traditional energy has risen rapidly, prompting European countries to actively promote energy transformation. The installation demand of photovoltaic equipment has increased significantly in major countries such as Germany, Spain, Poland, the Netherlands, etc., the demand has increased significantly, and many countries with small demand in the past have also seen multiple growth.

Asia Pacific: Asia Pacific imported 28.5 gigawatts of PV modules from China in 2022, up 27% from 2021. Major demand countries include India, Japan and Australia.

Americas: Total imports of components from China reached 24.8 gigawatts in 2022, an increase of 50% over 2021, with 80% of the increase coming from Brazil.

Middle East: Typical countries are the United Arab Emirates and Saudi Arabia, both of which saw a substantial increase in the amount of PV modules imported from China in 2022. Among them, the UAE imported 3.6 gigawatts of PV modules from China, an increase of up to 340 percent compared to 2021, making it the largest importer of Chinese modules in the Middle East. Saudi Arabia imported 1.2 gigawatts of photovoltaic modules from China, a significant increase from less than 0.1 gigawatts of demand in 2021.

In addition to components, China’s cumulative export of battery pieces in 2022 was $4.03 billion, up 40.66% year on year; The cumulative export of inverters was $8.975 billion, up 75.11% year-on-year.

3. Forecast of the development trend of photovoltaic industry in 2023

The whole year continued to open high trend. Although the first quarter is usually the off-season for installed capacity in Europe and China, recently, the continuous release of new silicon production capacity has led to the downward price of the industrial chain, effectively alleviated the downstream cost pressure, and stimulated the release of installed capacity. At the same time, overseas photovoltaic demand in February to March is expected to continue January “off-season is not weak” trend. According to the feed-back of the top component enterprises, the component scheduling increase trend is clear after the Spring Festival. The average month-on-month increase rate in February is 10%-20%, and the month-on-month increase rate in March will further increase. From the second and third quarters, with the continuous decline of supply chain prices, it is expected that the demand will continue to pick up until the end of the year, there may be large-scale grid connection tide again, driving the installed volume in the fourth quarter to reach the annual peak.

The industry is becoming increasingly competitive. In 2023, the interference or influence of geopolitics, great power game, climate change and other factors on the entire industrial chain and supply chain will continue, and the international photovoltaic industry competition will become increasingly fierce. From the perspective of products, enterprises to increase efficient product research and development, is to improve the global competitiveness of photovoltaic products; From the perspective of industrial layout, the supply chain of photovoltaic industry in the future will shift from centralization to diversification and diversification. According to different market characteristics and policy conditions, scientific and reasonable distribution of overseas industrial chain and overseas market is a necessary means for enterprises to enhance global competitiveness and reduce market risks.

4. The development situation of the photovoltaic industry in the medium and long term

The global photovoltaic industry has high development potential, and the demand for products supporting the photovoltaic industry chain remains high. From a global perspective, the transformation of energy structure to the direction of diversification, clean, low-carbon is an irreversible trend, and governments around the world actively encourage enterprises to develop the solar photovoltaic industry. In the context of energy transition, combined with the favorable factors of the reduction of photovoltaic power generation cost brought by technological progress, the demand for installed photovoltaic power overseas will continue to maintain a high boom in the medium term. According to the forecast of the China Photovoltaic Industry Association, in 2023, the global new PV installed capacity will be 280-330 gigawatts, and in 2025, the global new PV installed capacity will be 324-386 gigawatts, and the demand for products supporting the PV industry chain will remain high. After 2025, considering the factors of market consumption and supply and demand matching, there may be a certain excess capacity of photovoltaic products in the world.

China’s photovoltaic products have the advantage of linkage of industrial chain, and their export is highly competitive. China’s photovoltaic industry has the world’s most complete supply chain advantage of photovoltaic industry, complete industrial supporting, upstream and downstream linkage effect, production capacity and output advantage is obvious, which is the basis of supporting product export. At the same time, China’s photovoltaic industry continues to innovate, leading the world in technology, which lays a foundation for seizing international market opportunities. In addition, digital and intelligent technologies have accelerated the digital transformation and upgrading of the manufacturing industry, greatly improving production efficiency.

Photovoltaic core devices are developing towards the direction of high efficiency, low energy consumption and low cost, and cell conversion efficiency is the key technical factor to break through the bottleneck of photovoltaic industry. Under the premise of balancing cost and efficiency, once the battery technology with high conversion performance breaks through to mass production, it will quickly occupy the market and eliminate low-end production capacity. The product chain and supply chain balance between the upstream and downstream of the industrial chain will be restructured accordingly. At present, crystalline silicon cell is still the mainstream technology in the photovoltaic industry, which also constitutes the high consumption of upstream raw material silicon. Perovskite thin film cell, which is regarded as the representative of the third generation of efficient thin film cell, has significant advantages in energy conservation and environmental protection, design and application, raw material consumption and other aspects. At present, this technology is still in the laboratory stage, once the technical breakthrough is achieved, Substituting crystalline silicon cells becomes the mainstream technology, and the bottleneck of raw materials in the upstream industry chain will be broken.

International competition risks need attention. While the global photovoltaic application market is maintaining strong demand, the international competition in the photovoltaic manufacturing industry is increasingly intensified. Some countries are actively planning to localize the production, manufacturing and supply chain of the photovoltaic industry, and raise the development of new energy manufacturing to the government level, and there are goals, measures, and steps. For example, the US 2022 Inflation Reduction Act plans to invest $30bn in production tax credits to promote the processing of solar panels and key products in the US; The European Union plans to achieve a complete PV industrial chain of 100 gigawatts by 2030; India has unveiled a National Plan for High Efficiency solar photovoltaic Modules, which aims to increase local manufacturing and reduce its dependence on imports in the renewable energy sector. At the same time, some countries restrict the import of photovoltaic products of our country for their own interests, which causes certain influence on export of photovoltaic products. But in terms of the time cycle, it will take at least two to three years for these countries to establish a complete photovoltaic industry chain, during which time they will still need to import overseas products to support the development of domestic infrastructure. At the same time, considering the market supply and demand matching factors, 2025 will be the golden period for the development of the domestic photovoltaic industry, but also the window period for enterprises to expand production.